Robotic Process Automation (RPA): A Crunch Time In Indian Accounting

RPA Is Changing The Accounting And Finance Operations Fast. It Is Gaining Traction Fast. But Why? Read On…

RPA is a hot cake now in Indian Accountancy.

RPA can be used to reduce data transcribing tasks by 80% in accounts, financial close, tax accounting, and more. It’s a balm for the limitations of legacy and systems of finance and accountancy.

The User interface (UI) based robotics is emerging as a feasible solution to streamlining Accounts, Finance, and Tax process that are still manual, repetitive, and time-consuming (despite IT and other automation efforts).

Robotic Process Automation(RPA) use cases in Accounting and Finance

Here’s a list of functions that RPA bots can do…

Using Various Applications

- Opening emails and attachments

- Logging into applications

- Moving files and folders

Integration

- Connecting to system APIs

- Reading and writing to databases

Data Management

- Website and social media data

Data processing

- Following logical rules

- calculations

- Extracting data from documents

- Inputting data to forms

- Extracting/ reformatting data into reports / dashboards

- Merging data from multiple sources

- Copying/ pasting data

How RPA Is Shaping Indian Accounting

RPA has changed gear from mere mimics of humans to learn to interpret human behavior using machine language. They can be now used for informed and predictive decision making.

The following are the finance areas where RPA is contributing…

1. Finance Closure

Often in large organizations, this process is conducted across multiple locations and involves a highly rule-based repetitive process. For example, it may need an exchange of lots of emails, spreadsheets calculations, manual closure process.

RPA can help in automating the process offering end-to-end visibility like…

- Automating data input into spreadsheets, tracking

- Account records including cash, ledger to a spreadsheet

- Improve consistency and quality of financial data

- Automate workflow, centralize operations, reduce operating and labor costs

2. Tax Function

RPA can help in automating all repetitive, manual, and time-consuming tax processes enhancing direct/indirect tax compliance and reporting. It creates a significant impact on accuracy due to reduced error, increased visibility.

Some RPA-Tax tasks (among many others) are…

- Accounts review ensuring consistency with the previous year and noting the changes

- Analyze account changes to evaluate the potential tax impact

- Execute the work-flow processes for tax returns and initiate estimated payments

- High volume data collection, canalization

- Submit tax returns/payments

- Free staff time otherwise used to perform work like data extraction, manipulation

- Speeding up of tax provision timing by reducing manual work by 20%-35%

3. Automating Invoice Recon

A big issue with large organizations where manual invoice recon is a time-consuming process coming with the risk of revenue leakage as the invoices are generally pdfs (can range up to 200 pages) and often in multiple languages. Naturally, invoice reconciliation is prone to error.

Through Natural Language Processing (NLP), RPA can…

- Automate invoice reconciliations

- Load and identify functional information from invoices

- Synthesizes data from multiple input formats and extracts functional information

- Translates requirements into automated, executable process workflow and submits an analysis

4. MIS Reporting, Analytics

RPA can source, load, and streamline data for management reporting and better decision making. It can extract actual-performance data from ERP and compare it against the spreadsheet projections.

RPA can help to prepare the following types of reports…

- Cash Flow Projection

- Credit Report

- Budget Vs Actual

- Profitability Statement

- Management Estimates

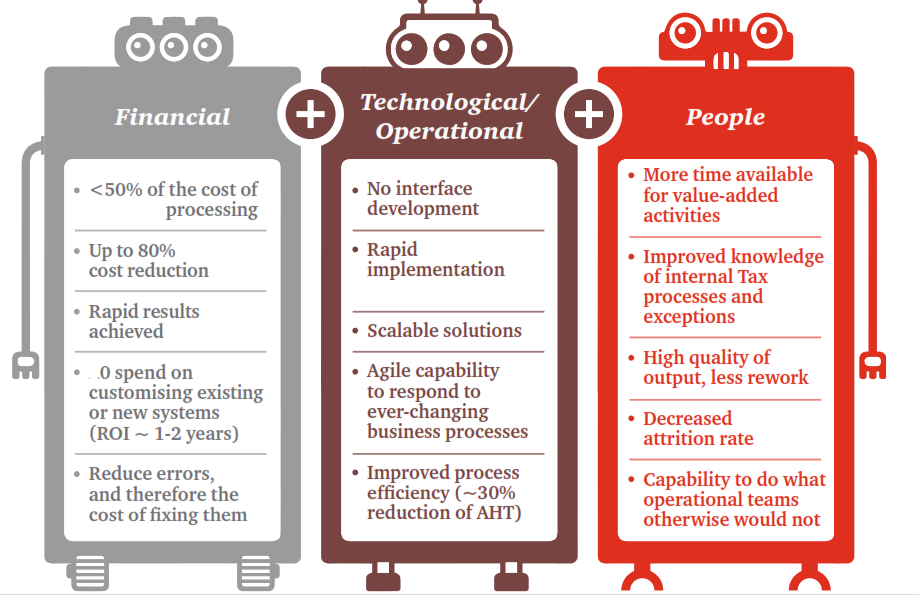

RPA does bring a cascading impact on Indian Accounting. It reduces cost, improves efficiency, directs time, energy, and focus of employees towards more value-added tasks bringing job satisfaction. Besides, RPA is easy to deploy and functions with equal efficiency across all financial.

Comments

Post a Comment